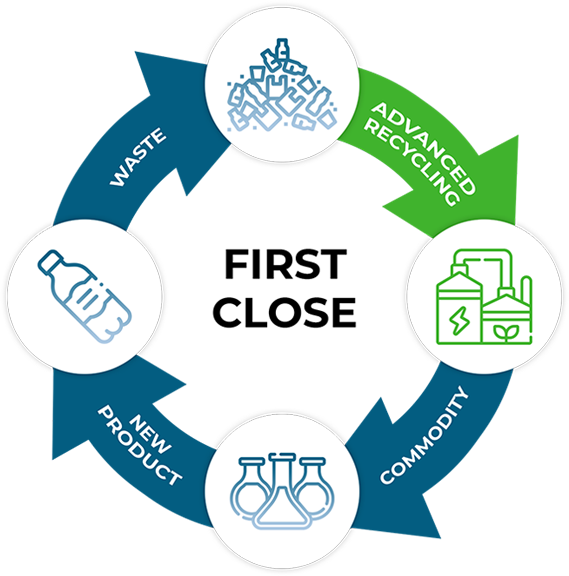

Alterra, a leader in plastic circularity process technology, announced today the first closing of its latest equity investment round with funding from Infinity Recycling, LyondellBasell and Chevron Phillips Chemical. This investment round will accelerate the commercialization of Alterra's Advanced Recycling technology, designed to transform discarded plastic into valuable raw materials, creating a more sustainable and circular economy.

Infinity Recycling led the financing round via its Circular Plastics Fund. Alterra also received additional equity investments as part of this round from Finnish circular and renewable feedstock solutions partner Neste and long-term private investor Potenza Capital.

Alterra's innovative technology converts discarded plastic into valuable resources, reducing landfill dependence and supporting the transition to a circular economy. With this new funding, the company aims to deploy its solutions globally, reinforcing its commitment to sustainable plastics management.

Fred Schmuck, CEO of Alterra, stated, "This funding marks a pivotal moment in our journey. We are excited to collaborate with our strategic partners to scale our technology and bring effective recycling solutions to communities around the world. Together, we can make a meaningful impact on the environment and create a more sustainable future."

Arie Hooimeijer, Head of Investments at Infinity Recycling, added, "Investing in Alterra aligns with our mission to support innovative solutions in the circular plastics economy. The advanced recycling technology developed by Alterra not only reduces plastic waste by re-using plastic materials but also unlocks new economic opportunities. We are thrilled to be part of this transformative effort."

Martino Gabellich, Vice President of Advanced Recycling and Low Carbon Solutions at LyondellBasell, remarked, "Our investment in Alterra demonstrates our commitment to capturing value from plastic waste and preventing it from going to incineration or landfills. These continuous investments along the value chain will help us scale our range of circular and low carbon solutions for our customers, while also contributing to the efforts to build a circular economy that benefits society and the planet."

Benny Mermans, Vice President of Sustainability at Chevron Phillips Chemical, remarked, "This investment in Alterra reflects our company's broader sustainability goals, including collaborating globally to advance the circular economy. We support ending plastic waste in the environment by sustainably recycling used plastics to create new and valuable products."

We are thrilled to have Upsolv join our portfolio! An exciting opportunity that marks Infinity Recycling's first investment in dissolution technology and expands our landscape beyond Europe.

Styrenic products are an integral part of our everyday lives, found in a wide range of applications from insulation materials to consumer electronics and automotive parts. These materials are valued for their durability, versatility and cost-effectiveness. Upsolv is at the forefront of transforming the way styrenic products are recycled. The company's innovative use of essential oils in their dissolution process offers a new way to recycle polystyrene, which is then cleaned and converted to one of the highest quality recycled styrenic products available. This method not only significantly reduces the environmental footprint of styrenic waste but contributes to IRC's mission to build a circular economy in plastics.

The closing of the first tranche of the Series B funding round raised no less than $16 million, with Infinity Recycling leading the round, followed by SWEN Blue Ocean and Earth Foundry, as the team shares: “This announcement, in the current economical context, reflects the unwavering support of our investors in our team and our proven technology, which is not only economically viable but also represents the shortest recycling loop for this type of waste, greatly reducing its environmental footprint. All the conditions for success are thus met to move forward with the next steps towards our first commercial plant in Montréal. This is a key step in the promotion of our technology, which will allow us to achieve our ambitious goals in order to break into strategic global markets and position ourselves as a key player in the circularity of styrenic plastics in collaboration with the industrial leaders of this value chain,” said Ms. Nathalie Morin, President and CEO of Upsolv.

Groningen , the Netherlands - BioBTX, a pioneering developer of renewable aromatics technology in the Netherlands, has secured over €80 million to launch its first commercial-scale plant. This investment will fund theworld's first renewable chemicals plant utilizing BioBTX's innovative ICCP Technology to produce sustainable aromatics (BTX) from plastic waste and biomass.

By converting plastic waste and biomass into renewable aromatics, BioBTX is spearheading the creation of a circular chemical industry, significantly reducing carbon emissions and reliance on fossil fuels.

Aromatics, essential for producing every-day products like insulating foams, coatings, PET bottles, batteries, and pharmaceuticals, will now have a sustainable alternative to fossil-based sources, presenting a major opportunity for circular business models.

As a leading technology developer since 2012, Groningen-based BioBTX aims to scale up its revolutionary technology at the PETRA Circular Chemicals Plant in Delfzijl. The PETRA plant will convert 20,000 tons of mixed plastic waste annually into renewable aromatics, replacing fossil resources and recycling low-value plastic waste into high-value chemicals. Once production is proven, the company intends to roll out the technology to chemical industry customers world-wide.

The € 80 million investment round includes € 42 million in equity from new shareholders Invest-NL, Infinity Recycling, and Covestro, alongside existing shareholders Carduso Capital, NOM and Groninger Groeifonds, and others. Additional funding comprises of € 15 million in debt financing from the Polestar Capital Circular Debt Fund and € 4 million from the Province of Groningen, a € 14 million grant from the Dutch Government via RVO, and other subsidies. Invest-NL's investment is partly backed by InvestEU, a European Commission program that supports initiatives aligned with EU policy priorities.

Securing such an amount with new partners mentioned above is impressive, looking at the current investment climate, and highlights the confidence in BioBTX's innovative approach.

Ton Vries, CEO of BioBTX, says: “We are extremely proud welcoming this unique consortium of investors and finance providers. A milestone like this is only achieved when parties come together to contribute to a greater goal. This funding is a crucial step in creating a sustainable pathway for the chemical industry - and we are excited to take the lead from Groningen.”

Infinity Recycling ("IRC"), a growth capital platform dedicated to investing in circular economy solutions, is delighted to announce the successful final close of its Circular Plastics Fund I SCSp ("CPF"). The final close exceeded the fund's €150 million target, securing a total of € 175 million in committed capital from institutional investors and value chain partners from across the world, giving it an unique position as an accelerator in the transition to a circular economy.

IRC has had the privilege of welcoming an impressive group of institutional investors since the fund's last close in December 2024 including Dutch insurance group ASR, Danish philanthropic association Realdania, ING Sustainable Investments, the sustainable Investments arm of ING, Danish investment and holding company KIRKBI, and the impact investment initiative of Swiss company Après-demain.

The CPF, an Article 9 'dark green' impact fund under the EU's Sustainable Finance Disclosure Regulation, was established to help accelerate the world's transition to a circular economy of materials. It does this by supporting advanced recycling technologies with the scaling up of their technology and the strengthening of their business propositions. The tremendously successful fundraise is testament to the growing enthusiasm amongst institutional investors for impactful investment opportunities in the circular economy.

This important milestone for IRC coincides with the recent passing of the European Packaging and Packaging Waste Regulation ('PPWR'), itself paving the way for advanced recycling to be counted as recycling. By valorising residual waste streams into primary commodities used in the production of new materials, CPF's investments plays a pivotal role in fostering sustainability and decarbonization of the chemical industry.

To date the CPF has gained significant momentum, investing in five portfolio companies (Pryme N.V., Itero Technologies Limited, Clariter S.A., DePoly S.A., and Ioniqa B.V.) deploying over EUR 45 million and with a strong pipeline of transactions. IRC's unique ability to provide both capital and operational expertise has enabled long-term value creation, generating promising returns while making a tangible impact on sustainability.

"The support for new technologies and their scaling up is paramount in enabling additional capital to enter the market and support the transition towards a circular economy. By fostering innovation and scalability, we unlock the potential for greater investment, accelerating our collective journey towards a more sustainable future"

"The strong interest from institutional investors, keen to make an environmental impact, is a clear endorsement of our mission: catalysing the world's transition to a circular economy of materials. We are thankful for the confidence of the Limited Partners in our unique investment focus and quality of execution"

Ioniqa Technologies B.V. ('Ioniqa') is pleased to announce a significant growth investment by Infinity Recycling ('IRC')'s Circular Plastics Fund to help accelerate the scale-up and roll out of its enhanced PET Polyester recycling technology.

Ioniqa's innovative technology upcycles low-grade post-consumer plastic waste to a virgin-like quality feedstock. With the ability to process coloured plastic waste flakes Ioniqa's technology offers a solution to process PET waste that is currently non-recyclable, creating a recycled material suitable for high quality food grade applications. Ioniqa has successfully demonstrated this technology in an industrial production facility in The Netherlands, and is now bringing it to market with strategic licensing partner Koch Technology Solutions.

Infinity Recycling provides growth capital to those companies that can help accelerate the creation of a circular economy for plastics, and subsequently helps them to scale. Ioniqa's enhanced recycling solution stands out by complementing existing recycling technologies with a cost-efficient solution, therewith catalysing the scale up of the industry as a whole.

Tonnis Hooghoudt, Founder and CEO of Ioniqa, said, "Developing a groundbreaking new technology like ours is a matter of patience, dedication and funding. With this investment by IRC we can further extend Ioniqa's horizon with a view to successfully launch industrial licenses for new customer plants worldwide. Furthermore, the investment allows Ioniqa to broaden the types of feedstocks it can process by adding Polyester fibres to our scope".

Jeroen Kelder, Managing Partner at Infinity Recycling, commented, "we have followed Tonnis and the team for a few years now and are thrilled to help the company further scale up and roll out its groundbreaking technology. The world is in urgent need of circular solutions for the plastics packaging and clothing markets. Ioniqa has developed an efficient solution that can turn low grade PET (and polyester) waste into materials suitable for high quality food grade or clothing applications". Arie Hooimeijer, Infinity Recycling's Head of Investments said, "We are looking forward to working with the Ioniqa team and its partner Koch Technology Solutions to accelerate the company's success and deliver real impact for our stakeholders and most importantly for the environment".

About Ioniqa

Ioniqa is a clean-tech spinoff from the Eindhoven University of Technology (The Netherlands), specialized in creating value out of waste by using its proprietary circular technology. With a cost-effective process, Ioniqa is able to close the loop for plastics, starting with PET plastics. Winner of the 2019 National Icon and supported by Dutch ministry of economic affairs, Ioniqa's innovation transforms all types and colours of PET waste into valuable sources for ‘virgin-quality' recycled PET. Upcycling processes for other types of plastic are being researched and expected to be launched in the near future.

ROTTERDAM, Netherlands, Jan. 16, 2024 -- Infinity Recycling ("IRC"), an growth capital platform investing in circular economy solutions, is pleased to announce the fifth close of its Circular Plastics Fund I SCSp ("CPF") in December 2023. With the onboarding of three new institutional Limited Partners, the fund has reached EUR 135 million in committed capital from a wide range of institutional investors based in Europe and beyond.

The CPF, with an initial target size of €150 million and backed by a broad range of international investors, is an Article 9 'dark green' impact fund under the EU's Sustainable Finance Disclosure Regulation.

Its investments aim to accelerate the transition to a circular economy of plastics by scaling up advanced recycling technology companies with strong growth prospects that transform plastic waste streams into primary commodities used to produce new plastics. The contribution of the fund's investors will expedite the commercialisation of the advanced recycling market, playing a role in enabling a circular economy for plastics and contributing to decarbonisation across the industry.

The new LP's include Investeringsfonds Groningen ("IFG") "For IFG, the investment is obvious", says fund manager Jan Timmer. "We want to move from fossil to circular and sustainable and are always looking for the best way to achieve that goal. Setting up a green chemistry plant is extremely capital intensive, so it makes sense that we look at funds like CPF. Especially because it does not only provide capital, but also expertise and advice that the entrepreneurs in Groningen can benefit from."

Since the fund's launch in February 2022, the team has gained momentum and made significant inroads by investing in five portfolio companies, with three follow-on investments and over EUR 40 million AUM. IRC's ability to support promising technologies with both the capital and operational expertise required for long term value creation, helps deliver private equity returns and proven impact. The strong collaborative nature of its investment strategy means that IRC has positioned itself as a trusted and critical partner in the transition to a circular economy of plastics.

"The strong interest from institutional investors, keen to make an environmental impact, is a clear endorsement of our mission: catalysing the world's transition to a circular economy of plastics. We are thankful for the support from new limited partners such as IFG, who have recognised Infinity Recycling's differentiated investment focus", shared Jeroen Kelder, Managing Partner at Infinity Recycling.

Rotterdam, the Netherlands — Infinity Recycling BV, a growth capital firm investing in advanced plastics recycling technologies, is pleased to announce the highly anticipated new closing of its Circular Plastics Fund I (CPF), achieving €105.3 million in committed capital. The backing from its new investors, which include the European Investment Fund (EIF) and GC Ventures (CVC of PTTGC), underscores the strong market confidence in Infinity Recycling's vision and growth prospects.

The CPF, with an initial target size of €150 million, is an Article 9 'dark green' impact fund under the EU's Sustainable Finance Disclosure Regulation. Its investments aim to accelerate the transition to a circular economy of plastics by scaling up advanced recycling technology companies with strong growth prospects that transform plastic waste streams into primary commodities used to produce new plastics. The contribution of the fund's investors will expedite the commercialisation of the advanced recycling market, playing a role in enabling a circular economy for plastics and contributing to decarbonisation across the industry.

"Sustainability is key to our business operations and our commitments”, contributed Kamel Ramdani, Senior Vice President of PTTGC and MD of GC Ventures. “Applying the circular economy principle to closed-loop plastic waste management, recycling, and upcycling is mandatory. This includes developing new solutions through innovation and their market impact to better meet people's needs.”

Since the fund's launch in February 2022, the team has gained momentum and made significant inroads by investing in four portfolio companies, with three follow-on investments, all well-positioned to deliver private equity market returns and lasting impact. Infinity Recycling, together with the management teams of the portfolio companies have embarked on a journey to achieve operational excellence for long-term value creation and sustainable development to attain these goals.

“We are pleased to have such well-regarded investors in the Circular Plastics Fund and are thankful for the support from new limited partners such as EIF and GC Ventures, who have recognised Infinity Recycling's differentiated investment focus”, shared Jan-Willem Muller, Managing Partner at Infinity Recycling.

Infinity Recycling BV was established in 2019 to create markets for end-of-life waste streams by investing in advanced technologies that enable circularity in the plastics industry. Their first offering, the Circular Plastics Fund, contributes to solving the plastic waste problem and unlocking much-needed capacity in high- in-demand recycled commodities. The fund implements a return and impact-driven investment strategy that drives value creation in advanced recycling and accelerates the transition to a circular economy for plastics. Building on the momentum in investor interest and deployment, the fund is well on its way to final closing, projected for Q4 2023.

This is a marketing communication. Please refer to the private placement memorandum of the AIF before making any final investment decisions.

Read more on the press release:

For more information, please contact:enquiries@infinity-recycling.com

#marketingcommunication

Infinity Recycling is pleased to announce the co-investment in its portfolio company DePoly SA, together with BASF Venture Capital, Wingman Ventures, Beiersdorf, CIECH Ventures, Zürcher Kantonalbank, Angel Invest, ACE & Company, and others.

This CHF 12.3 million seed funding supports DePoly's next phase of growth, bridging a crucial gap in circular PET usage by preserving desired quality standards effectively at commercial scale.

Samantha Anderson, CEO and co-founder of DePoly, said, "By recycling pre- / post-consumer and post-industrial plastics that otherwise would be sent to incineration centers or be landfilled, we at DePoly aim to eliminate plastic waste and create a sustainable source of chemicals by diverting this waste from our environment and lowering our carbon footprint up to 65% at the same time. The raw materials produced match that of their fossil-fuel-based equivalents, meaning customers no longer have to choose between PET quality and its sustainability."

Jan Willem Muller, Managing Partner at Infinity Recycling, commented, "We believe that DePoly has the team and the drive to bring their groundbreaking innovation for polyester recycling to market. Together with DePoly's partners, we are supporting a significant step forward in our joint mission to tackle the global plastic and clothing waste crisis, transforming the future of recycling."

Infinity Recycling is pleased to announce the co-investment in its portfolio company Pryme, together with Invest-NL and LyondellBasell.

This EUR 13 million investment supports Pryme's next phase of growth, enabling its pyrolysis process to convert used plastic into valuable products on an industrial scale.

"We are excited to welcome this group of strong investors at our side," said Chris Herve, CEO of Pryme. “Just like earlier investments by Infinity Recycling and Stichting Multistrat opened doors and allowed us to gain important market knowledge, we expect our new investors to each bring valuable experience and perspective to further develop our technology. With this dedicated support comes responsibility and expectation to deliver - a challenge we gladly accept.

Jeroen Kelder, Managing Partner, Infinity Recycling, said: "Infinity Recycling is pleased to announce that it has successfully assembled a strong consortium of investors to support its portfolio company Pryme in its next phase of growth. We are proud to have facilitated this important milestone for Pryme and are confident that this backing will be instrumental in its continued success."

Infinity Recycling is pleased to announce the successful closing of a new round of commitments to their Circular Plastics Fund. The new investors include Vopak Ventures B.V., Westlake Innovations, a subsidiary of Westlake Corporation and Dutch multi-family office Commenda.

The Luxembourg-registered Circular Plastics Fund (CPF) has an initial target size of EUR 150 million. CPF is an Article 9 'dark green' impact fund, under the EU's Sustainable Finance Disclosure Regulation. Its investments aim to accelerate the transition to a circular economy of plastics by scaling up advanced recycling technology companies that transform plastic waste streams into primary commodities used for production of new plastics.

Walter Moone, president New Energies and LNG at Vopak said: "We are pleased to partner with Infinity Recycling in our efforts to support the chemical industry to become more sustainable. Advanced recycling of plastics is a key aspect within our strategy to accelerate towards new energies and sustainable feedstocks. We believe that this will play an important role in the future of the chemical industry and are excited to contribute."

Jan-Willem Muller, Managing Partner at Infinity Recycling added: "We are very happy to welcome these new Limited Partners to our Circular Plastics Fund. Their contributions will help us to increase our impact and support more companies with the expansion of their plastics recycling capacity. And as we focus on scaling-up successful technologies, there is limited technical risk involved and it mostly comes down to commercialisation. We are grateful for this sign of confidence support and look forward to working together to create a more sustainable future."

"Westlake is proud and glad to join the Circular Plastics Fund in its mission to repurpose plastic waste and promote a circular economy," Said John Chao, Vice President and Managing Director, Westlake Innovations. "The Fund's objectives align with our objective to seek investment opportunities in new technologies including innovative digital, mechanical or chemical applications such as carbon sequestration or recycling. We are looking forward to collaborating with the Fund and its other investors.”

Since its first closing in February 2022, the Fund has made five investments. Building on investor interest and deployment momentum, the Fund is well on its way to a final closing, projected for the second half of this year. The next subsequent closing is planned for May 2023. taking total commitments to ~70% of the Fund's target (EUR 150m).

About Infinity Recycling:

Infinity Recycling was established to create markets for end-of-life waste streams by investing in waste valorisation technologies. Their first offering, the Circular Plastic Fund, makes a significant contribution to solving the plastic waste problem and unlocking much-needed capacity in high-demand recycled commodities. The Fund implements a return-driven investment strategy that drives value creation in advanced recycling and accelerates the conversion to a circular economy for plastics.

About Circular Plastics Fund:

The Circular Plastics Fund, catalyses the world's transition to a closed-loop plastics economy in which residual polymer waste streams, representing over 85% of the global plastic waste e, are converted into building blocks for the manufacturing of new plastics. The Fund's strategy aims to significantly reduce the carbon footprint of the plastics economy and contribute to eliminating the world's plastic waste problem.

Clariter and Dutch impact investor Infinity Recycling are pleased to announce Infinity's Circular Plastics Fund's strategic investment in the further development of Clariter's commercial plants.

With this investment, Infinity joins a number of organizations that have invested in Clariter over the last year, highlighting strong investor confidence in Clariter's breakthrough chemical upcycling technology.

Increased consumer environmental awareness has also increased the momentum of circular economy innovators like Clariter, whose breakthrough chemical recycling technology can upcycle a wide range of plastics.

Clariter provides a new, profitable alternative for traditional plastic waste. The company's proprietary technology transforms most plastic waste streams into high-quality, high-value products that can be used as inputs into over 1,000 sustainable industrial and consumer products.

With its profitable, net-carbon-negative and resource-efficient plastic-to-products solution, Clariter stands out in its field with the potential to become a powerful solution to the world's plastic waste problem.

Infinity Recycling's Circular Plastics Fund aims to support businesses scaling up their proven, advanced recycling technologies, making Clariter an ideal partner.

Common goals unite the two companies: to connect the value chain, prove the complementarity of mechanical and advanced recycling, and finally tackle the global plastic waste crisis.

Clariter's Founder and CEO, Ran J. Sharon, said: "Clariter is on the cusp of a new phase in its evolution, with its impending global rollout and rapid growth. We have spent 19 years perfecting our technology to create a viable solution to plastic waste - creating high- quality, high-value products from most types of plastic waste using a highly efficient process with minimal waste and emissions. Having achieved a mature and market-ready technology, it is the perfect time to partner with expansion-oriented impact investors like Infinity. This investment will accelerate our growth, bringing us faster towards a sustainable future for us all."

Jan Willem Muller, Infinity's Managing Partner added:

"Having followed Clariter's evolution over the last few years, we are delighted to see the strides the company has made in developing its business, as well as their ESG focus, which we are eager to help Clariter mature in line with the sustainability principles that underpin the Circular Plastics Fund. Infinity is pleased to be able to step in as an investor and support the scaling up of a technology that differentiates itself in the plastics recycling industry by making end-products that can be directly used in consumer products manufacturing, reducing the market's dependency on fossil feedstock."

The investment was made under Article 9 of the Sustainable Finance Disclosure Regulation (SFDR), which improves the transparency in the market for sustainable investment products and mitigates the risk of greenwashing.

About Clariter:

Clariter is a global cleantech company that has developed a chemical recycling process that provides a solution to the plastic waste epidemic. This proprietary, efficient technology transforms plastic waste into high-quality, high-value products: oils, waxes, and solvents that replace fossil-based products. Clariter offers a commercially attractive combination of profitability and sustainability.

For further details, please contact Clariter's Public Relations Specialist, Barbara Ciesielska, at: barbara.ciesielska@clariter.com

About Infinity Recycling:

Infinity Recycling is a Rotterdam-based investment fund manager creating markets for end-of-life waste streams by investing in advanced recycling technologies. The team's experience in trading commodities and growth capital investing provides considerable value to technology companies, helping to convert valuable IP into profitable, scalable businesses. The Fund is committed to strong ESG performance and is classified as an Article 9 "dark green" impact fund, the highest designation under the EU's Sustainable Finance Disclosure Regulation (SFDR).

The Circular Plastics Fund (CPF) is moving apace, concluding a cornerstone investment in Itero Technologies (Itero), an advanced recycling technology firm that converts end-of-life plastic waste to tradable commodities. This is the second investment by the SFDR Article 9 “Dark Green Fund”, which backs companies scaling up proven advanced recycling technologies.

The Circular Plastics Fund (CPF) is moving apace, concluding a cornerstone investment in Itero Technologies (Itero), an advanced recycling technology firm that converts end-of-life plastic waste to tradable commodities. This is the second investment by the SFDR Article 9 “Dark Green Fund”, which backs companies scaling up proven advanced recycling technologies.

It is a growing global priority to decarbonise the economy and reduce dependency on fossil feedstocks. In addition to fostering local supply of feedstock, the circular economy is paramount to reducing the carbon footprint of plastics. The Circular Plastics Fund makes growth investments in technology companies that break surging plastic waste streams down into primary commodities, which can then be reused by the industry as inputs for new (plastic) products, enabling a circular economy in plastics.

Beyond funding, the Infinity Recycling (Infinity) team drives value by supporting portfolio companies to market their valuable products and optimise operations for impact. “Infinity's investment is recognition of the potential of Itero's technology, and it is meaningful to be working with a fund which is as dedicated to sustainability as we are at Itero.” said, Simon Hansford, Itero's CEO.

Jeroen Kelder, Infinity's Managing Partner: “Infinity's history with Itero goes back to 2019, and we have supported the company in key stages of its development. Our investment aims to accelerate the world's transition to the circular economy of plastics. Based on McKinsey & Co's 2022 report, an 8% market share of recycled polymers in the European plastics economy will require over EUR 40 billion investment. The current production of recycled polymer is negligible. We are thrilled to spearhead this crucial transition alongside Itero.”

The CPF achieved its first closing in February 2022, with strong backing from reputable investors, and is still welcoming new limited partners as the team prepares for further closings from later in the year.

Ends

About Infinity Recycling

Infinity Recycling was established by Jan Willem Muller and Jeroen Kelder to bring a return-driven approach to sustainability. The team's experience in trading commodities and corporate finance provides considerable value to the technology companies, helping to convert valuable IP into profitable, scalable businesses. Infinity Recycling creates markets for end-of-life waste streams by investing in advanced recycling technologies. Securing suitable waste streams and managing marketing of output through pricing options and structuring steady and scaled offtake contracts puts a return-driven approach to sustainability into practice. Transforming waste into chemical feedstock enables a circular economy, and generates significant, measurable financial and environmental returns.

Infinity Recycling's Circular Plastics Fund, has invested in Europe's single largest advanced recycling project for plastic waste being developed in Rotterdam via….

a private share placement in Pryme N.V., the cleantech developer of the technology for the plant. Pryme is listed and publicly traded on the Euronext Growth Market in Oslo. The EUR 6.3 million investment represents 40% of the private placement and provides Infinity Recycling's Circular Plastic Fund with a 20% stake in the company.

This is the first investment by the Circular Plastics Fund, which backs companies scaling up proven advanced recycling technologies to break down surging plastic waste flows into primary commodities, which can then be reused in perpetuity by the industry as inputs for new products. The Fund completed a successful initial capital raise in February where it received strong backing from global plastic supply chain investors and Invest-NL, the Dutch investment agency.

The Pryme plant, which is under construction in Rotterdam, is due to start commissioning in the fourth quarter of 2022 and will process about 40,000 tonnes of waste plastic annually once fully operational. Over the next five years, the Pryme technology will be rolled out in plants in Rotterdam and other key petrochemical hubs in Northwestern Europe, adding a further 160,000 tonnes in production capacity.

Jan-Willem Muller, Managing Partner at Infinity Recycling, said: “We are immediately putting to work the capital we have raised for the Circular Plastics Fund in one of the most pioneering advanced recycling projects in Europe. While there are other sites with greater capacity, these are processing modules linked together, and Pryme's Rotterdam development is going to be the largest single reactor in Europe. We need to develop many more advanced recycling plants of this scale to tackle the 'end-of-life' waste crisis created by the ever-linear growth in the consumption of plastics.”

The Pryme facility uses 'pyrolysis' technology, an efficient advanced recycling process which converts about 70% of the mixed plastic waste into a secondary raw material, pyrolysis oil, which can be used by the chemicals industry within existing infrastructure as a substitute for naphtha, the key component in the production of new plastic products. The energy used in the pyrolysis process produces around 70% lower carbon emissions than incineration, together with landfill and environmental leakage the main end-destinations for 80% of plastic waste globally, and represents around a 40% to 60% cut in CO2 emissions compared with the production of virgin feedstock from fossil fuels.

Pryme estimates more than 10 million tonnes of European plastic waste annually is suitable as feedstock for recycling in its plants and the technology will in the future make a significant contribution to the EU's target of 50% of plastic packaging waste being recycled in Europe by 2025. Dutch independent research organisation TNO estimated in 2021 that 92,000 tonnes of CO2 emissions a year could be avoided by chemical recycling (pyrolysis) of plastic waste versus incineration (energy recovery) for each Pryme reactor line of 40,000 tonnes.

Approximately 400 million tonnes of plastic waste, equivalent to over 35 kgs for each person on the planet, are created annually. Less than 10% of this is recycled globally. Management consultancy McKinsey & Co. estimates that the global market for advanced plastic recycling will reach 500 million tonnes per year by 2050, generating more than USD 300 billion in revenues and could account for around 40% of total virgin feedstock supply for new products.

The advanced 'upcycling' of waste complements mechanical recycling as it allows the conversion of even the most difficult plastic waste streams into valuable primary commodities and overcomes quality restrictions in the use of recycled materials in the manufacturing of new food packaging, which accounts for around 40% of global plastic demand. When plastics are mechanically recycled around six times, they also become unusable for producing new products.

Johannes van der Endt, Founder and CEO of Pryme, said: “The investment by Infinity Recycling's Circular Plastics Fund will allow Pryme to complete its advanced recycling plant in Rotterdam and takes us a big step closer to a true low carbon circular market for plastics at the heart of Europe's petrochemical industry. It enables a validation of our low carbon technology on industrial scale by the end of this year, which will be followed by an ambitious rollout across Europe and around the world, in collaboration with our strategic partners. “

Infinity Recycling's Circular Plastics Fund is an Article 9 'dark green' impact fund, the highest designation under the EU's Sustainable Finance Disclosure Regulation (SFDR), delivering significant CO2 reductions, while targeting a net IRR of 18% to 22%. The Luxembourg-registered fund has an initial investment target of EUR 150 million.

Ends

Media contacts:

Bellier Communication

Global Plastic Supply Chain Investors Line-up at First Close of Infinity Recycling's Circular PlasticsFund, Backing Companies Converting Waste toPrimary Commodities to Reverse Pollution Crisis

ROTTERDAM, Feb 11, 2022 - Infinity Recycling's Circular Plastics Fund, which will invest in companies scaling up proven advanced recycling technologies to break down surging plastic waste flows....

into primary commodities to be reused in perpetuity by the industryas inputs for new products, has received strong backing at its first capital close from global plastic supply chain investors, as well as Invest-NL, the Dutch investment agency.

Investors include U.S. petrochemical companies, Chevron Philips Chemical and LyondellBasell, Singapore-based global materials organisationIndorama and Invest-NL, which have initially committed over EUR 40 million to the fund's Rotterdam-based investment management team. The Circular Plastics Fund is an Article 9 'dark green' impact fund, the highest designation under the EU's Sustainable Finance Disclosure Regulation (SFDR), and targets a net IRR of 18% to 22%. The Luxembourg-registered fund has an initial investment target of EUR 150 million.

The ever-linear consumption of plastics is creating an 'end-of-life' waste crisis. Approximately 400 million tonnes of plastic waste are created annually, equivalent to over 35 kgs for each person on the planet,but less than 20% of this is recycled globally. The remainder ends up in landfills, incinerators, or being leaked into the environment.

Jeroen Kelder, Managing Partner at Infinity Recycling, said: "The world is being overwhelmed by plastic waste and supply continues to grow exponentially because demand isn't slowing down, which means current approaches focused on mechanical recycling will be unable to stem the tide. The Circular Plastics Fund addresses this gap in the market bysupporting companies with tried and tested advancedrecycling technologies and enabling them to scale-up."

The advanced 'upcycling' of waste complements mechanical recycling because it allows the conversion of even the most difficult plastic waste streams into valuable primary commodities and overcomes quality restrictions in the use of recycled materials in the manufacturing of new food packaging, which accounts for around 40% of global plastic demand.3 Management consultancy McKinsey estimates that the global market for advanced recycling plastic will reach 500 million tonnes per year by 2050, generating more than USD 300 billion in revenues and could account for around 40% of total virgin feedstock supply for new products.

Jan-Willem Muller, Managing Partner at Infinity Recycling, said: "We believe that locally sourced waste can be utilised within the existing petrochemical market infrastructure, and that is the fastest and most scalable solution for this existential crisis. It is very appropriate, therefore, that our Circular Plastics Fund has successfully completed its first capital close in the 'Week of the Circular Economy' in the Netherlands."

Global Plastic Supply Chain Investors and Invest-NL Commit to Circular Plastics Fund

Wouter Bos, Invest-NL CEO, said: "Invest-NL is backing Infinity Recycling's Circular Plastics Fund as a cornerstone investor because the fund will invest in innovative technologies that enable the industry to increase the amount of high quality recycled plastics from low quality plastic waste streams. This fits our goal of creating a more circular and sustainable Dutch economy."

Benny Mermans, Vice President of Sustainability at Chevron Phillips Chemical (CPChem) said: "Our company is committed to ensuring plastics continue to deliver societal benefits without having a negative impact on the environment by producing our life-enriching products sustainably, leaving behind the lightest footprint and enabling others to do so as well. Plastic waste is a valuable resource and keeping it in the loop as long as possible will contribute to the creation of a circular economy for plastics. Through this investment in Infinity Recycling's Fund, our company aims to support the most promising advanced recycling technologies, connect the value chain and prove the complementarity of mechanical and advanced recycling, all important steps to accelerate change for a sustainable future."

Richard Roudeix, Senior Vice President Olefins and Polyolefins, EMEA and India at LyondellBasell concluded: “We believe collaboration across the value chain is critical to our joint success as we seek to end plastic waste in the environment. LyondellBasell's commitment to Infinity Recycling, our first fund investment in Europe, reflects our dedication to accelerate efforts to achieve a circular economy for plastics by catalyzing further investment in recycling technologies. Plastics enable a modern society and are essential to developing a more sustainable world. Through this fund, we aim for society to continue to realise the benefits of these materials by supporting the continued development of recycling technologies to increase the recyclability of plastic waste."

New Amsterdam is the placement agent for the Circular Plastics Fund; Loyens & Loeff the legal advisors, Mazars Group provided audit and tax advisory and Sustainable Capital Group advised on sustainability-related compliance. Trustmoore Luxembourg is the fund's administrator.

Infinity Recycling creates markets for end of life waste streams by investing in advanced recycling technologies and connecting the value chain.

Follow us on linkedin